Next-Generation Wealth Creation DAO

Next-Generation Wealth Creation DAO

Next-Generation Wealth Creation DAO

The Future of Wealth Creation on SUI Network

The Future of Wealth Creation on SUI Network

The Future of Wealth Creation on SUI Network

AI Treasury Management

RWAs Integration

Dynamic Membership

AI Treasury Management

RWAs Integration

Dynamic Membership

Layer 1

SUI

Layer 2

Optimism

Layer 2

Linea

Layer 2

Polygon

Layer 2

Palm

Layer 1

Celo

Layer 2

Starknet

Layer 2

Arbitrum

Layer 1

Avalanche

Layer 1

SUI

Layer 2

Optimism

Layer 2

Linea

Layer 2

Polygon

Layer 2

Palm

Layer 1

Celo

Layer 2

Starknet

Layer 2

Arbitrum

Layer 1

Avalanche

Layer 1

SUI

Layer 2

Optimism

Layer 2

Linea

Layer 2

Polygon

Layer 2

Palm

Layer 1

Celo

Layer 2

Starknet

Layer 2

Arbitrum

Layer 1

Avalanche

Layer 1

SUI

Layer 2

Optimism

Layer 2

Linea

Layer 2

Polygon

Layer 2

Palm

Layer 1

Celo

Layer 2

Starknet

Layer 2

Arbitrum

Layer 1

Avalanche

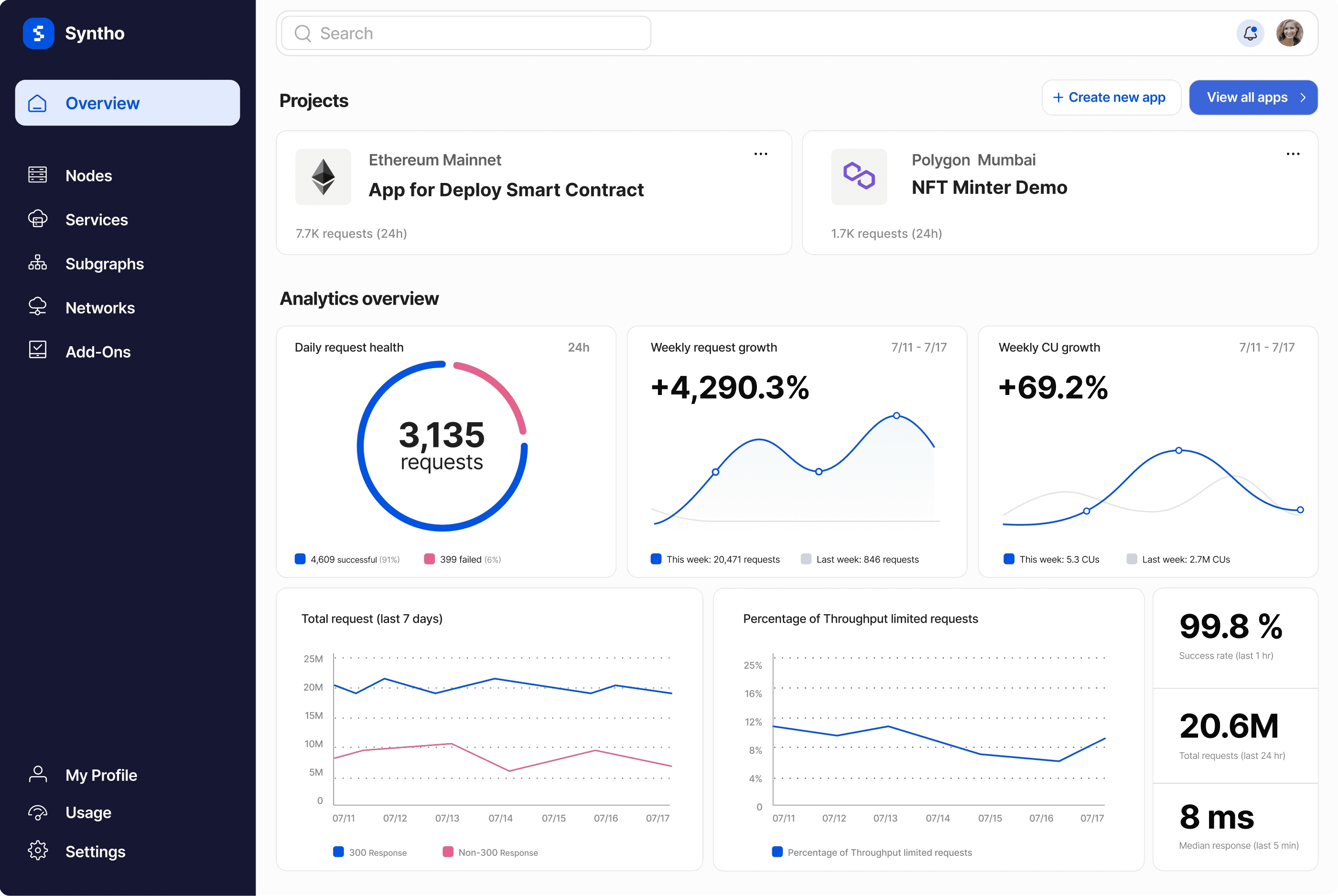

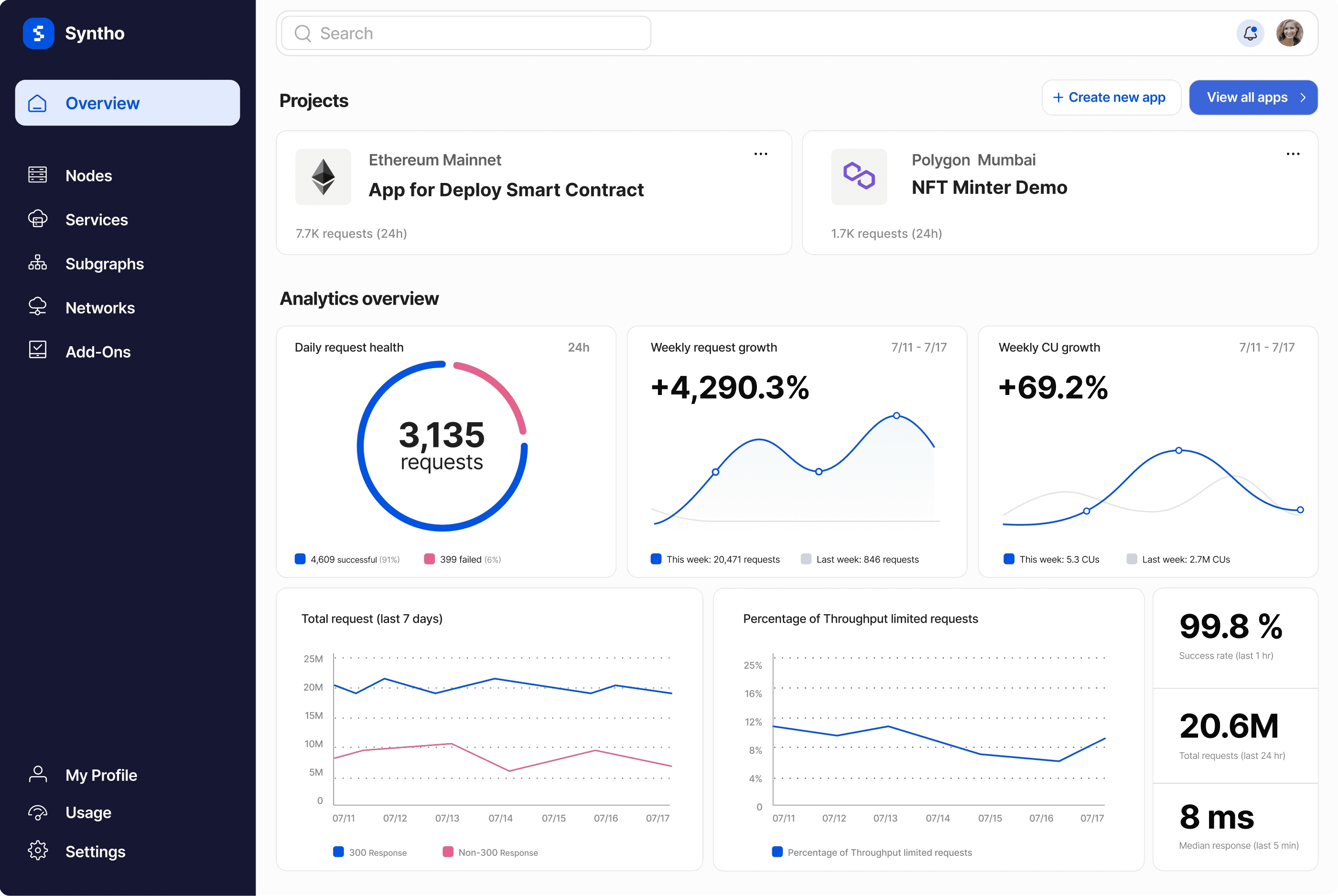

Developer-friendly tools and APIs

AI-Powered Treasury Management

Uishi’s treasury management system deploys autonomous AI agents to manage capital across SUI’s DeFi ecosystem. These agents operate within community-defined parameters, executing strategies that would be impossible through manual governance.

The system architecture comprises specialized agents for different functions. A market analysis agent continuously monitors on-chain and off-chain data sources, tracking price movements, yield curves, liquidity depths, and sentiment indicators across SUI and connected chains. A risk management agent enforces position limits, monitors for liquidation risks, and implements portfolio hedge strategies when volatility exceeds defined thresholds. Execution agents interact directly with DEXs, lending protocols, and re-staking contracts to implement strategy decisions.

The strategy portfolio spans multiple return-generating activities optimized for SUI’s unique characteristics. Liquidity provision strategies deploy capital into DeepBook, Cetus, and other SUI DEXs, capturing trading fees while maintaining withdrawal flexibility. Lending strategies utilize Suilend, NAVI, and other lending protocols to earn yield on stablecoin and SUI deposits, with AI-driven rebalancing between protocols based on rate differentials. Restaking strategies capture both staking rewards and additional yield from security provision. Cross-chain strategies leverage SUI’s cross-bridge infrastructure to capture yield differentials between chains.

Developer-friendly tools and APIs

AI-Powered Treasury Management

Uishi’s treasury management system deploys autonomous AI agents to manage capital across SUI’s DeFi ecosystem. These agents operate within community-defined parameters, executing strategies that would be impossible through manual governance.

The system architecture comprises specialized agents for different functions. A market analysis agent continuously monitors on-chain and off-chain data sources, tracking price movements, yield curves, liquidity depths, and sentiment indicators across SUI and connected chains. A risk management agent enforces position limits, monitors for liquidation risks, and implements portfolio hedge strategies when volatility exceeds defined thresholds. Execution agents interact directly with DEXs, lending protocols, and re-staking contracts to implement strategy decisions.

The strategy portfolio spans multiple return-generating activities optimized for SUI’s unique characteristics. Liquidity provision strategies deploy capital into DeepBook, Cetus, and other SUI DEXs, capturing trading fees while maintaining withdrawal flexibility. Lending strategies utilize Suilend, NAVI, and other lending protocols to earn yield on stablecoin and SUI deposits, with AI-driven rebalancing between protocols based on rate differentials. Restaking strategies capture both staking rewards and additional yield from security provision. Cross-chain strategies leverage SUI’s cross-bridge infrastructure to capture yield differentials between chains.

Global node network

Real-World Asset Integration

Uishi’s RWA layer bridges on-chain and off-chain wealth, enabling DAO members to access traditional asset classes through SUI’s infrastructure. We acquire and fractionalize assets that provide diversification, stable yields, and inflation hedging unavailable in purely crypto-native strategies.

Our acquisition strategy focuses on asset categories where tokenization provides clear advantages over traditional ownership structures. Private credit opportunities—small business loans, invoice financing, and merchant cash advances—offer yields of eight to twelve percent with relatively predictable cash flows. Tokenized real estate, particularly commercial properties in secondary markets, provides rental income and potential appreciation with the fractional ownership enabled by SUI’s object model. Commodities including precious metals and energy credits offer inflation hedging and store-of-value properties.

Kiosk infrastructure integration leverages SUI’s unique asset custody system for sophisticated RWA management. The Kiosk system enables conditional asset transfers, escrowed transactions, and complex custody arrangements that would require extensive custom development on other platforms. For RWA management, Kiosk enables structures where assets can be fractionally owned, transferred only under specific conditions, or managed through multi-signature arrangements—all with native protocol support.

Global node network

Real-World Asset Integration

Uishi’s RWA layer bridges on-chain and off-chain wealth, enabling DAO members to access traditional asset classes through SUI’s infrastructure. We acquire and fractionalize assets that provide diversification, stable yields, and inflation hedging unavailable in purely crypto-native strategies.

Our acquisition strategy focuses on asset categories where tokenization provides clear advantages over traditional ownership structures. Private credit opportunities—small business loans, invoice financing, and merchant cash advances—offer yields of eight to twelve percent with relatively predictable cash flows. Tokenized real estate, particularly commercial properties in secondary markets, provides rental income and potential appreciation with the fractional ownership enabled by SUI’s object model. Commodities including precious metals and energy credits offer inflation hedging and store-of-value properties.

Kiosk infrastructure integration leverages SUI’s unique asset custody system for sophisticated RWA management. The Kiosk system enables conditional asset transfers, escrowed transactions, and complex custody arrangements that would require extensive custom development on other platforms. For RWA management, Kiosk enables structures where assets can be fractionally owned, transferred only under specific conditions, or managed through multi-signature arrangements—all with native protocol support.

Stability assurance

Dynamic Membership System

Uishi’s membership layer transforms passive token holding into an active, evolving relationship between members and the DAO. We leverage SUI’s object model to create membership credentials that accumulate attributes based on participation.

Dynamic NFTs serve as membership credentials that evolve over time. Each member’s NFT accumulates attributes reflecting governance participation, treasury contributions, community engagement, and tenure. These attributes determine membership tier, voting power, fee structures, and access to exclusive opportunities. The system incentivizes active participation while creating a visible record of member contributions.

The reputation and credential system enables members to build portable reputations within the SUI ecosystem. Attributes accumulated through Uishi membership could potentially integrate with other SUI protocols, creating a broader identity layer that enhances access and opportunities across the ecosystem. This interoperability creates additional value for active members while encouraging long-term engagement.

Access-gated opportunities provide tier-based access to premium investment opportunities. Entry-level members access basic yield strategies and RWA positions. Higher tiers, earned through contribution and tenure, unlock access to exclusive RWA deals, early-stage protocol investments, and higher-yielding DeFi strategies. This structure creates clear incentives for engagement while ensuring that members with greater commitment access greater opportunities.

Stability assurance

Dynamic Membership System

Uishi’s membership layer transforms passive token holding into an active, evolving relationship between members and the DAO. We leverage SUI’s object model to create membership credentials that accumulate attributes based on participation.

Dynamic NFTs serve as membership credentials that evolve over time. Each member’s NFT accumulates attributes reflecting governance participation, treasury contributions, community engagement, and tenure. These attributes determine membership tier, voting power, fee structures, and access to exclusive opportunities. The system incentivizes active participation while creating a visible record of member contributions.

The reputation and credential system enables members to build portable reputations within the SUI ecosystem. Attributes accumulated through Uishi membership could potentially integrate with other SUI protocols, creating a broader identity layer that enhances access and opportunities across the ecosystem. This interoperability creates additional value for active members while encouraging long-term engagement.

Access-gated opportunities provide tier-based access to premium investment opportunities. Entry-level members access basic yield strategies and RWA positions. Higher tiers, earned through contribution and tenure, unlock access to exclusive RWA deals, early-stage protocol investments, and higher-yielding DeFi strategies. This structure creates clear incentives for engagement while ensuring that members with greater commitment access greater opportunities.

Revenue Streams

Our Web3 IaaS simplifies app development with secure, scalable blockchain deployment. Innovate worry-free.

Revenue Streams

Our Web3 IaaS simplifies app development with secure, scalable blockchain deployment. Innovate worry-free.

Treasury Yield Generation

Treasury Yield Generation

AI-driven DeFi strategies optimizing returns across lending and liquidity protocols.

AI-driven DeFi strategies optimizing returns across lending and liquidity protocols.

Performance & Management Fees

Tiered fees on yields generated for premium staked token holders.

Performance & Management Fees

Tiered fees on yields generated for premium staked token holders.

Performance & Management Fees

Tiered fees on yields generated for premium staked token holders.

Real-World Asset Returns

Interest and dividends from private credit, real estate, and revenue-sharing agreements.

Real-World Asset Returns

Interest and dividends from private credit, real estate, and revenue-sharing agreements.

Real-World Asset Returns

Interest and dividends from private credit, real estate, and revenue-sharing agreements.

AI Agent Services API

SaaS subscriptions granting external access to Uishi's AI strategy infrastructure.

AI Agent Services API

SaaS subscriptions granting external access to Uishi's AI strategy infrastructure.

Dynamic NFT Membership

Revenue from tiered access passes, collectible badges, and premium content gating.

Dynamic NFT Membership

Revenue from tiered access passes, collectible badges, and premium content gating.

Liquidity Provision

Spreads and incentives earned providing market-making services across SUI DEXs.

Liquidity Provision

Spreads and incentives earned providing market-making services across SUI DEXs.

Team

Team

Team

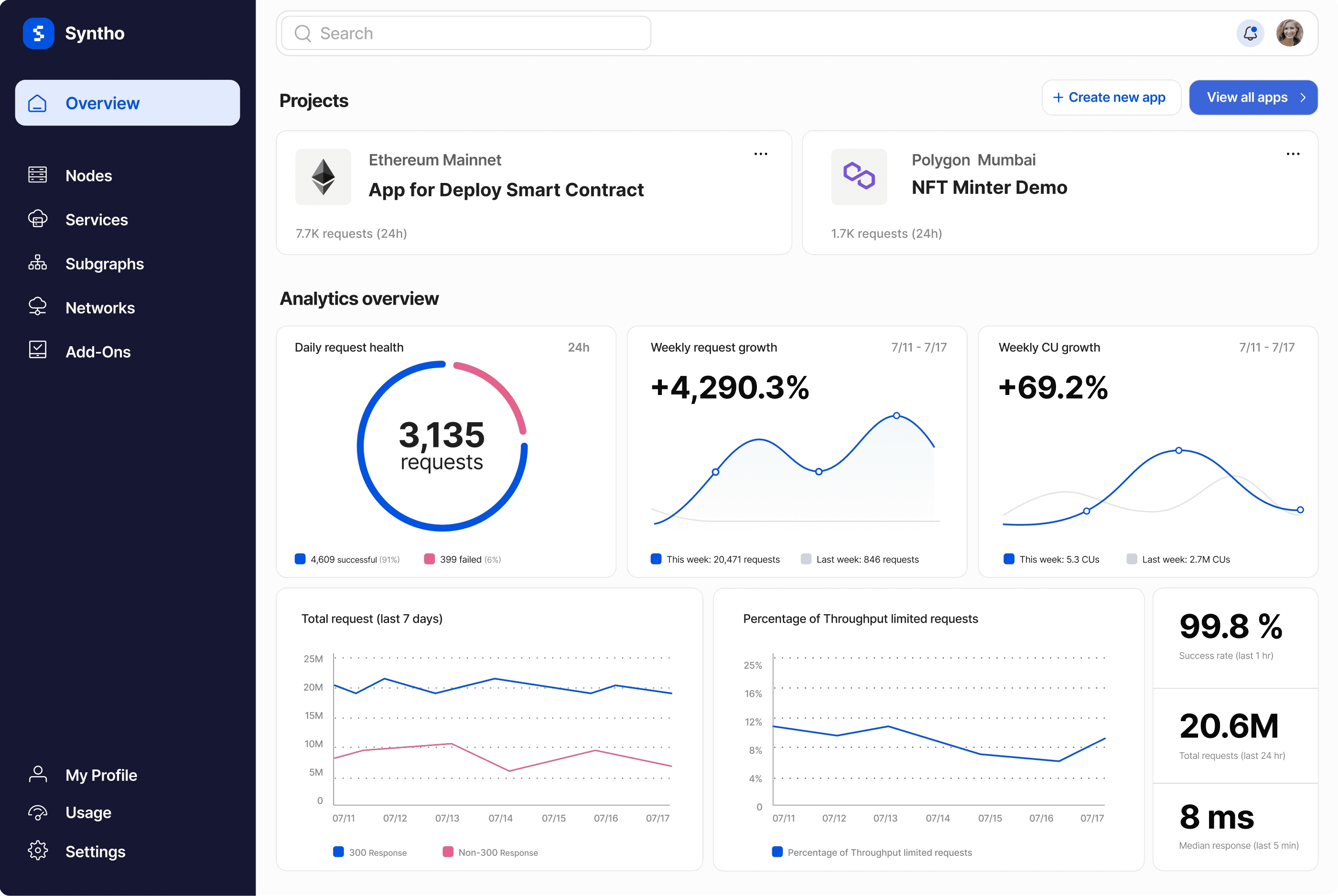

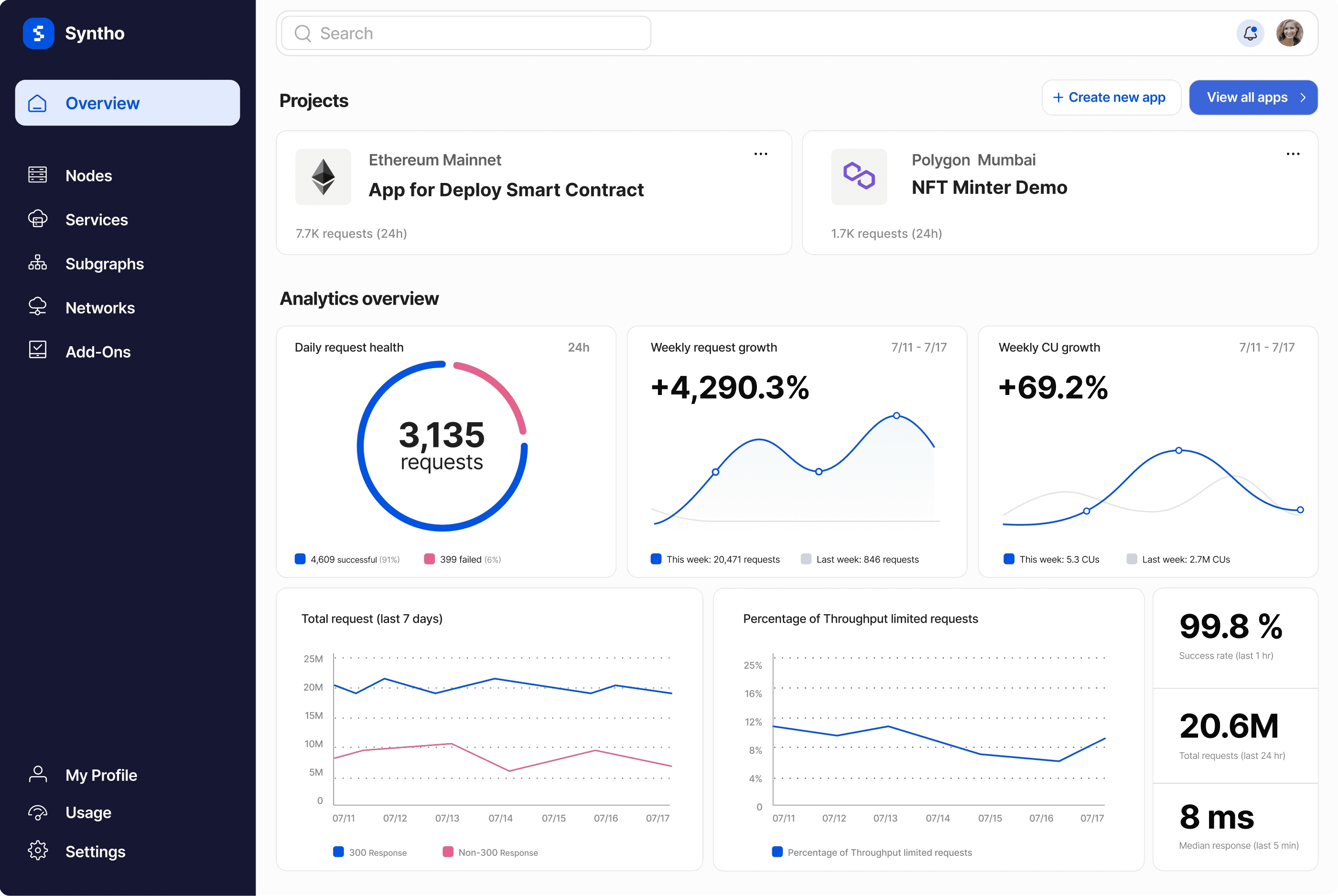

Hear what our customers have to say

Emily Johnson

Blockchain Developer

Using Syntho has brought unprecedented stability and scalability to our Web3 project. We can now handle more transactions and user interactions without any downtime. This has greatly enhanced our user experience.

Ethan Taylor

Data Analyst

With Syntho's support, we can easily access and manage historical data, which is crucial for our applications. The ability to retrieve and analyze past transactions has significantly improved our operational efficiency.

Ava Thompson

System Architect

Syntho's real-time analytics allow us to quickly track and optimize our system performance. The detailed metrics and insights provided have helped us to identify and resolve bottlenecks promptly.

Emily Johnson

Blockchain Developer

Using Syntho has brought unprecedented stability and scalability to our Web3 project. We can now handle more transactions and user interactions without any downtime. This has greatly enhanced our user experience.

Emily Johnson

Blockchain Developer

Using Syntho has brought unprecedented stability and scalability to our Web3 project. We can now handle more transactions and user interactions without any downtime. This has greatly enhanced our user experience.

Ethan Taylor

Data Analyst

With Syntho's support, we can easily access and manage historical data, which is crucial for our applications. The ability to retrieve and analyze past transactions has significantly improved our operational efficiency.

Ava Thompson

System Architect

Syntho's real-time analytics allow us to quickly track and optimize our system performance. The detailed metrics and insights provided have helped us to identify and resolve bottlenecks promptly.

Emily Johnson

Blockchain Developer

Using Syntho has brought unprecedented stability and scalability to our Web3 project. We can now handle more transactions and user interactions without any downtime. This has greatly enhanced our user experience.

Emily Johnson

Blockchain Developer

Using Syntho has brought unprecedented stability and scalability to our Web3 project. We can now handle more transactions and user interactions without any downtime. This has greatly enhanced our user experience.

Ethan Taylor

Data Analyst

With Syntho's support, we can easily access and manage historical data, which is crucial for our applications. The ability to retrieve and analyze past transactions has significantly improved our operational efficiency.

Ava Thompson

System Architect

Syntho's real-time analytics allow us to quickly track and optimize our system performance. The detailed metrics and insights provided have helped us to identify and resolve bottlenecks promptly.

Emily Johnson

Blockchain Developer

Using Syntho has brought unprecedented stability and scalability to our Web3 project. We can now handle more transactions and user interactions without any downtime. This has greatly enhanced our user experience.

Benjamin Williams

Security Engineer

Our security needs are fully met with Syntho's world-class security measures. The token-based authentication and domain masking features ensure our data remains protected at all times.

Olivia Martinez

Product Manager

Syntho's unlimited scalability gives us the confidence to meet future growth demands. Whether we have hundreds or millions of users, Syntho scales seamlessly with our needs, allowing us to focus on innovation.

Liam Anderson

Backend Developer

After using Syntho, our node execution efficiency and reliability have significantly improved. The ability to re-execute transactions with detailed data collection has been a game-changer for us.

Benjamin Williams

Security Engineer

Our security needs are fully met with Syntho's world-class security measures. The token-based authentication and domain masking features ensure our data remains protected at all times.

Benjamin Williams

Security Engineer

Our security needs are fully met with Syntho's world-class security measures. The token-based authentication and domain masking features ensure our data remains protected at all times.

Olivia Martinez

Product Manager

Syntho's unlimited scalability gives us the confidence to meet future growth demands. Whether we have hundreds or millions of users, Syntho scales seamlessly with our needs, allowing us to focus on innovation.

Liam Anderson

Backend Developer

After using Syntho, our node execution efficiency and reliability have significantly improved. The ability to re-execute transactions with detailed data collection has been a game-changer for us.

Benjamin Williams

Security Engineer

Our security needs are fully met with Syntho's world-class security measures. The token-based authentication and domain masking features ensure our data remains protected at all times.

Sophia Brown

Transaction Specialist

Syntho allows us to easily manage and track transactions, and quickly resolve issues. The comprehensive debugging tools have reduced our troubleshooting time drastically.

Jacob Wilson

Tech Lead

With Syntho's broad access, we can easily connect to multiple blockchain networks. This flexibility has enabled us to expand our services and offer more to our clients.

Isabella Clark

Customer Support Manager

Syntho's user support is prompt and professional, giving us great peace of mind during use. Their team is always ready to assist, ensuring we can maintain smooth operations.

Sophia Brown

Transaction Specialist

Syntho allows us to easily manage and track transactions, and quickly resolve issues. The comprehensive debugging tools have reduced our troubleshooting time drastically.

FAQ

FAQ

FAQ

What is Uishi?

Uishi is a next-generation Decentralized Autonomous Organization built on the SUI Network that transforms traditional DAO governance into a high-performance wealth generation machine. Unlike legacy DAOs focused primarily on governance voting, Uishi integrates AI-powered treasury management, Real-World Asset (RWA) investments, and dynamic NFT-based membership into a unified ecosystem. The platform leverages SUI's unique technical advantages—including its object-centric architecture, Move programming language, and Agentic Payments Protocol—to create autonomous wealth-building strategies that benefit all token holders.

What is Uishi?

Uishi is a next-generation Decentralized Autonomous Organization built on the SUI Network that transforms traditional DAO governance into a high-performance wealth generation machine. Unlike legacy DAOs focused primarily on governance voting, Uishi integrates AI-powered treasury management, Real-World Asset (RWA) investments, and dynamic NFT-based membership into a unified ecosystem. The platform leverages SUI's unique technical advantages—including its object-centric architecture, Move programming language, and Agentic Payments Protocol—to create autonomous wealth-building strategies that benefit all token holders.

What is Uishi?

Uishi is a next-generation Decentralized Autonomous Organization built on the SUI Network that transforms traditional DAO governance into a high-performance wealth generation machine. Unlike legacy DAOs focused primarily on governance voting, Uishi integrates AI-powered treasury management, Real-World Asset (RWA) investments, and dynamic NFT-based membership into a unified ecosystem. The platform leverages SUI's unique technical advantages—including its object-centric architecture, Move programming language, and Agentic Payments Protocol—to create autonomous wealth-building strategies that benefit all token holders.

What is Uishi?

Uishi is a next-generation Decentralized Autonomous Organization built on the SUI Network that transforms traditional DAO governance into a high-performance wealth generation machine. Unlike legacy DAOs focused primarily on governance voting, Uishi integrates AI-powered treasury management, Real-World Asset (RWA) investments, and dynamic NFT-based membership into a unified ecosystem. The platform leverages SUI's unique technical advantages—including its object-centric architecture, Move programming language, and Agentic Payments Protocol—to create autonomous wealth-building strategies that benefit all token holders.